Commonly, if you only generate income from your perform being an staff and It really is under the normal deduction for your personal submitting status, you needn't file a tax return. The threshold for needing to file a tax return is $four hundred of self-work net income.

running self-work taxes is such a huge deal when you're a freelancer or gig employee. given that the small business proprietor, don't forget, You must pay out in Social stability and you've got to pay for in Medicare, and now that you're both equally employer and worker, you have to pay each side. whenever you experienced an employer therefore you had been owning a particular amount of money withheld out of one's Look at as well as your net check was considerably less, well, your employer was shelling out website the identical quantity on the opposite side in the equation.

Learning these significant goods once could make it easier to now and down the road. getting a deeper amount of engagement may lead to improved being familiar with, and tactic for getting ready your taxes in potential several years.

A local tax skilled matched for your exceptional situation will find every single greenback you are worthy of and Obtain your taxes accomplished correct - when now.

ahead of taking any motion, you'll want to always seek out the assistance of the professional who is aware of your individual circumstance for advice on taxes, your investments, the law, or another business and professional matters that impact you and/or your small business.

A educated tax professional will have in-depth know-how and knowledge of such legal guidelines, guaranteeing that the LLC stays compliant.

being a founder, you’re typically for the helm of innovation, navigating uncharted waters as you completely transform your visi...

Online communities are like digital hangouts wherever those with shared interests connect. They’re much more th...

consequently, you wish to you should definitely're crafting off the small business operator deduction, residence office deduction, car expenditures, cellular phone and meals to the benefit of the employee. you might be the worker. you wish to consider all those deductions. Ask oneself, What do I must perform this task?

Professional associations may additionally be improved Geared up to connect you by using a tax preparer whose experience and history meet your requirements.

fulfillment assured: you might use TurboTax Online at no cost up to The purpose you decide to print or electronically file your tax return.

when you add services, your support costs will be adjusted appropriately. when you file right after 11:59pm EST, March 31, 2024, you'll be billed the then-existing list cost for TurboTax Live Assisted standard and point out tax filing is an extra rate. See latest rates below.

existence insurance policies guideLife insurance coverage ratesLife insurance policies and coverageLife coverage quotesLife insurance policies reviewsBest lifetime insurance plan companiesLife insurance plan calculator

Tax Lawyers are folks certified to practice regulation who focus on tax matters. They are really Specially handy When you have a dispute While using the IRS and are looking to have it solved in court. Tax attorneys are professionals at handling audits and appeals and in negotiating With all the IRS around payment and collection concerns specially when you must check out court.

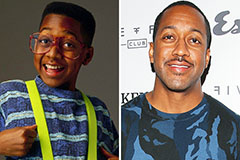

Jaleel White Then & Now!

Jaleel White Then & Now! Neve Campbell Then & Now!

Neve Campbell Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Robert Downey Jr. Then & Now!

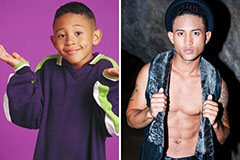

Robert Downey Jr. Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now!